Als Kleinunternehmer gelten Unternehmen mit geringem Umsatz, die nach der Kleinunternehmerregelung die Rechnungsstellung erleichtert bekommen. Das unterstützt Gründer, die ein Unternehmen aufbauen möchten, ohne sofort viel Geld zu verdienen. Hier die wichtigsten Informationen im Überblick.

Kurz und kompakt: Besteuerung der Kleinunternehmer (§ 19 UStG)

Unternehmer mit geringem Umsatz müssen keine Umsatzsteuer erheben, wenn ihr Umsatz im Vorjahr 25.000 Euro nicht überstiegen hat und im laufenden Jahr 100.000 Euro nicht überschreitet. Diese neue Regelung gilt seit dem 1. Januar 2025.

- Was ist ein Kleinunternehmer?

- Das ändert sich ab 2025 im Vergleich zur alten Kleinunternehmerregelung

- Beispiel zur neuen Anwendung

- Vorteile der Kleinunternehmerregelung

- Einschränkungen und Verzichtsmöglichkeit

- Was gilt bei Neugründungen?

- Internationale Besonderheiten und neue EU-Regelung

- Weitere Hinweise zur Umsatzsteuererklärung

- FAQ zur Kleinunternehmerregelung

Was ist ein Kleinunternehmer?

Ein Kleinunternehmer im steuerlichen Sinn ist eine natürliche Person oder ein Einzelunternehmen, das bestimmte Umsatzgrenzen nicht überschreitet und daher von der Umsatzsteuerpflicht befreit ist. Die gesetzliche Grundlage dafür bildet § 19 UStG (Umsatzsteuergesetz).

Das bedeutet: Kleinunternehmer dürfen auf ihren Rechnungen keine Umsatzsteuer ausweisen und müssen auch keine Umsatzsteuer an das Finanzamt abführen. Im Gegenzug können sie aber auch keine Vorsteuer aus Eingangsrechnungen geltend machen.

Die wichtigsten Fakten zur neuen Kleinunternehmerregelung

Umsatzgrenzen: Unternehmer, die im vorangegangenen Kalenderjahr nicht mehr als 25.000 Euro Umsatz erzielt haben und im laufenden Jahr nicht mehr als 100.000 Euro umsetzen, können die Kleinunternehmerregelung nach § 19 UStG in Anspruch nehmen. Diese neue Regelung gilt seit dem 1. Januar 2025.

Vorteile: Die Regelung befreit von der Pflicht zur Abführung der Umsatzsteuer, erlaubt die Ausstellung von Rechnungen ohne Umsatzsteuerausweis und erspart die Umsatzsteuervoranmeldung – was den Verwaltungsaufwand erheblich reduziert.

Zielgruppe: Besonders relevant ist die Regelung für Gründer, Kleingewerbetreibende, Freiberufler und kleine Unternehmen, die sich auf ihr Kerngeschäft konzentrieren möchten, ohne sofort in die umsatzsteuerliche Regelbesteuerung einzusteigen.

Zweck: Die Kleinunternehmerregelung dient der Vereinfachung steuerlicher Pflichten und ermöglicht einen niedrigschwelligen Einstieg in die Selbstständigkeit – insbesondere für Unternehmer mit überschaubarem Jahresumsatz.

Nutzen: Sie verschafft finanzielle und organisatorische Entlastung in der Gründungs- oder Aufbauphase und sorgt dafür, dass Unternehmen ohne komplexe Umsatzsteuerpflichten erste Geschäftserfahrungen sammeln und wachsen können.

Der maßgebliche Gesamtumsatz ist der Nettobetrag aller steuerbaren Einnahmen eines Kalenderjahres. Ausgenommen sind bestimmte steuerfreie Umsätze (z. B. aus Vermietung) sowie Hilfsgeschäfte wie der Verkauf von Anlagevermögen.

Das ändert sich ab 2025 im Vergleich zur alten Kleinunternehmerregelung

Die bisherigen Umsatzgrenzen von 22.000 Euro (Vorjahr) und 50.000 Euro (geschätzt für das laufende Jahr) wurden angehoben. Entscheidend ist nun:

- Die Grenze von 100.000 Euro ist verbindlich. Sie ist nicht prognostisch – wird sie überschritten, entfällt die Anwendung der Kleinunternehmerregelung mit sofortiger Wirkung.

- Existenzgründer gelten automatisch als Kleinunternehmer, sofern sie im Gründungsjahr unter 25.000 Euro Umsatz bleiben. Eine Prognose entfällt.

Beispiel zur neuen Anwendung

in Unternehmer erzielt im Jahr einen Umsatz von 95.000 Euro bis Ende November. Im Dezember kommen 10.000 Euro hinzu – die Grenze von 100.000 Euro wird somit überschritten. Ab der Rechnung, mit der die Grenze überschritten wird, muss Umsatzsteuer ausgewiesen werden. Die vorherigen Umsätze bleiben steuerfrei.

Vorteile der Kleinunternehmerregelung

- Keine Umsatzsteuer auf Ausgangsrechnungen

- Keine monatlichen Umsatzsteuervoranmeldungen

- Vereinfachte Buchführungspflichten

- Geringere Einstiegshürden für neu gegründete Unternehmen

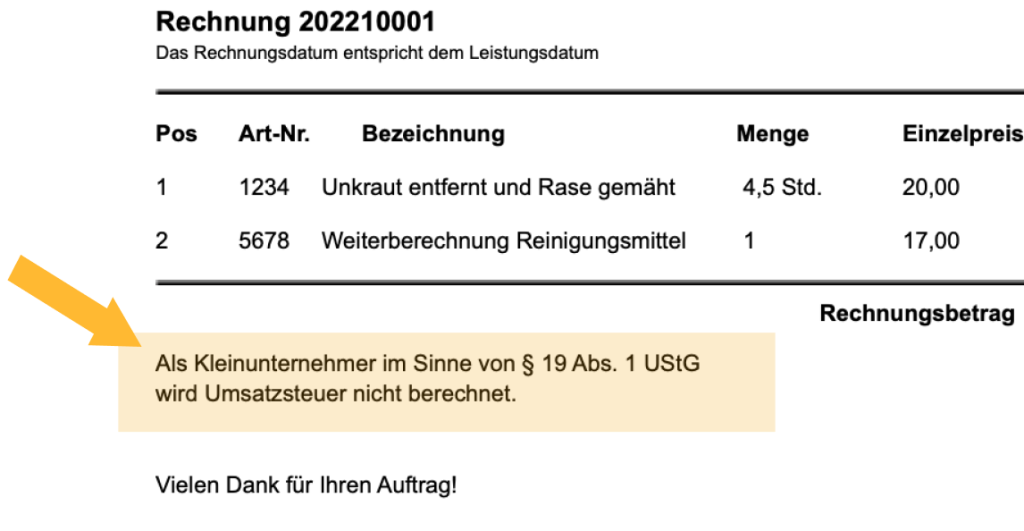

Wenn Sie als Kleinunternehmer tätig sind, dürfen Sie keine Umsatzsteuer ausweisen.

Es ist empfehlenswert, auf Rechnungen einen Hinweis wie etwa „Gemäß § 19 UStG wird keine Umsatzsteuer berechnet“ aufzunehmen.

Einschränkungen und Verzichtsmöglichkeit

In diesen Fällen kann es sinnvoll sein, freiwillig auf die Anwendung der Kleinunternehmerregelung zu verzichten. Dadurch erhalten Sie Zugang zum Vorsteuerabzug, müssen aber sämtliche umsatzsteuerlichen Pflichten erfüllen.

Die Kleinunternehmerregelung kann auch Nachteile mit sich bringen – insbesondere, wenn hohe Vorsteuern aus Investitionen entstehen oder überwiegend Geschäftskunden beliefert werden.

Ein erklärter Verzicht gilt für mindestens fünf Kalenderjahre und ist spätestens bis zum letzten Tag des Februars des übernächsten Jahres beim Finanzamt zu erklären.

Was gilt bei Neugründungen?

Für neugegründete Unternehmen gilt seit 2025:

- Es ist keine Umsatzprognose mehr erforderlich.

- Die Anwendung der Regelung erfolgt automatisch, wenn der tatsächliche Umsatz im Gründungsjahr nicht mehr als 25.000 Euro beträgt.

Wird diese Grenze im Laufe des Jahres überschritten, endet die Anwendung der Regelung mit dem Umsatz, der zur Überschreitung führt.

Internationale Besonderheiten und neue EU-Regelung

Kleinunternehmer müssen bei grenzüberschreitenden Geschäften besondere umsatzsteuerliche Regelungen beachten. Ab dem 1. Januar 2025 können Unternehmer mit einem Jahresumsatz unter 100.000 Euro EU-weit von einer vereinheitlichten Kleinunternehmerregelung profitieren.

Voraussetzung: Die Registrierung beim Bundeszentralamt für Steuern, die Beantragung einer speziellen Kleinunternehmer-Identifikationsnummer und die Einhaltung nationaler Schwellenwerte im Zielland.

Weitere Hinweise zur Umsatzsteuererklärung

Kleinunternehmer sind grundsätzlich von der Pflicht zur Abgabe einer Umsatzsteuerjahreserklärung befreit – es sei denn, sie werden vom Finanzamt dazu aufgefordert. In bestimmten Sonderfällen (z. B. bei Steuerschuldumkehr) kann dennoch eine Erklärung erforderlich sein.

Die überarbeitete Kleinunternehmerregelung bietet weiterhin einen bürokratiearmen Einstieg in die Selbstständigkeit. Gleichzeitig verlangt sie erhöhte Sorgfalt im Hinblick auf die neue Umsatzgrenze von 100.000 Euro. Unternehmerinnen und Unternehmer sollten frühzeitig prüfen, ob ein Wechsel zur Regelbesteuerung strategisch sinnvoll sein kann – etwa bei Investitionsvorhaben oder Geschäftskundenfokus.

Umsatzsteuer ist eine Steuer auf Lieferungen und Leistungen. Unternehmen stellen sie ihren Kunden in Rechnung und führen sie an das Finanzamt ab. Kleinunternehmer sind davon befreit – haben aber im Gegenzug kein Recht auf Vorsteuerabzug, also keine Erstattung der auf Eingangsrechnungen gezahlten Umsatzsteuer.

Für eine individuelle Einschätzung empfiehlt es sich, steuerlichen Rat einzuholen – insbesondere bei komplexeren Geschäftsmodellen oder grenzüberschreitenden Tätigkeiten.

FAQ zur Kleinunternehmerregelung

Wie lange gilt der Verzicht auf die Kleinunternehmerregelung und wie kann dieser widerrufen werden?

Ein erklärter Verzicht auf die Anwendung der Kleinunternehmerregelung bindet den Unternehmer für mindestens fünf Kalenderjahre. Ein Widerruf ist erst nach Ablauf dieser Frist möglich und muss dem Finanzamt vor Beginn des neuen Kalenderjahres, in dem die Regelung wieder gelten soll, mitgeteilt werden.

Beispiel: Wer 2025 auf die Anwendung verzichtet hat, kann frühestens ab 2031 wieder zur Kleinunternehmerregelung zurückkehren – sofern auch die Umsatzgrenzen eingehalten wurden.

Was passiert, wenn in einem Jahr nur eine der beiden Umsatzgrenzen überschritten wird?

Beide Grenzen – 25.000 Euro im Vorjahr und 100.000 Euro im laufenden Jahr – müssen eingehalten werden. Wird eine der beiden Grenzen überschritten, entfällt die Anwendung der Kleinunternehmerregelung vollständig.

Die Grenze für das laufende Jahr gilt dabei sofort: Der Umsatz, der zur Überschreitung der 100.000-Euro-Marke führt, unterliegt bereits der Regelbesteuerung.

Können auch Kapitalgesellschaften (z. B. GmbH oder UG) Kleinunternehmer sein?

Ja. Die Kleinunternehmerregelung ist rechtsformunabhängig. Voraussetzung ist allein, dass das Unternehmen als eigenständiger Unternehmer im Sinne des Umsatzsteuerrechts gilt und die Umsatzgrenzen eingehalten werden.

Auch eine GmbH oder UG kann die Regelung anwenden, sofern sie unterhalb der Umsatzschwellen bleibt.

Gilt die Kleinunternehmerregelung auch für freie Berufe?

Ja. Die Regelung kann auch von Freiberuflern in Anspruch genommen werden – beispielsweise von Ärzten, Architekten, Journalisten oder Steuerberatern – sofern die Umsatzgrenzen nicht überschritten werden.

Was ist bei mehreren selbstständigen Tätigkeiten zu beachten?

Umsatzsteuerlich gilt grundsätzlich ein einheitliches Unternehmen. Das bedeutet: Wenn eine Person mehrere selbstständige Tätigkeiten ausübt (z. B. Onlineshop + freier Texter), sind alle Umsätze zusammenzurechnen, um zu prüfen, ob die Kleinunternehmergrenzen überschritten werden.

Wie werden Umsätze bei Ratenzahlung oder Anzahlungen berücksichtigt?

Maßgeblich für die Umsatzgrenze ist der Zeitpunkt der Vereinnahmung. Das heißt: Umsätze zählen für das Jahr, in dem das Geld tatsächlich zugeflossen ist – nicht der Zeitpunkt der Rechnungsstellung oder Lieferung.

Beispiel: Eine Leistung wird im Dezember erbracht, die Zahlung erfolgt aber im Januar – dann zählt der Umsatz zum neuen Jahr.

Was gilt bei der Einfuhrumsatzsteuer?

Auch Kleinunternehmer müssen bei Warenimporten aus Drittländern Einfuhrumsatzsteuer zahlen. Diese kann allerdings – anders als bei regelbesteuerten Unternehmern – nicht als Vorsteuer geltend gemacht werden.

Können Kleinunternehmer freiwillig eine Umsatzsteuer-Identifikationsnummer (USt-IdNr.) beantragen?

Ja, eine USt-IdNr. wird auf Antrag vom Bundeszentralamt für Steuern vergeben – auch an Kleinunternehmer. Wer diese jedoch aktiv im grenzüberschreitenden Handel verwendet, kann steuerliche Konsequenzen auslösen, etwa eine Pflicht zur Erwerbsbesteuerung oder zur Abgabe einer Zusammenfassenden Meldung (ZM).

Es empfiehlt sich, vor Nutzung der USt-IdNr. im EU-Ausland steuerlichen Rat einzuholen.

Ist bei Rechnungen unter 250 Euro (Kleinbetragsrechnungen) ebenfalls ein Hinweis auf die Kleinunternehmerregelung erforderlich?

Ja. Auch bei Kleinbetragsrechnungen darf keine Umsatzsteuer ausgewiesen werden. Ein Hinweis auf die Steuerbefreiung nach § 19 UStG sollte – trotz vereinfachter Formvorgaben – enthalten sein, um Rechtssicherheit zu schaffen.

Welche Bedeutung hat die neue EU-weite Kleinunternehmerregelung ab 2025?

Ab dem 1. Januar 2025 können Unternehmer mit einem Jahresumsatz unter 100.000 Euro EU-weit vereinfachte Steuerbefreiungen in Anspruch nehmen – vorausgesetzt, sie erfüllen die nationalen Anforderungen des Ziellandes.

Dafür ist eine elektronische Registrierung beim Bundeszentralamt für Steuern (BZSt) nötig, inklusive Beantragung einer EU-Kleinunternehmer-Identifikationsnummer und vierteljährlicher Umsatzmeldung im sogenannten „besonderen Verfahren“.