The digitalization of business processes is progressing steadily in Europe. A central component of this development is the electronic invoice, also known as the e-invoice. More and more companies are turning to e-invoices to reduce paper consumption, optimize work processes and meet legal requirements. One important standard in this area is ZUGFeRD, which is becoming increasingly important and standardizes e-invoicing processes.

There are now many companies that only accept ZUGFeRD-compliant invoices. This mainly affects companies such as public administrations and offices. Numerous German companies are suppliers or contractual partners of public authorities and public service providers. The new standard will therefore be an important component in many companies, on both sides. The new format is also relevant for you, as you will have to provide it and the e-invoicing obligation will come into effect in Germany from 01.01.2025 at the latest.

What is ZUGFeRD?

ZUGFeRD (Zentraler User Guide des Forums elektronische Rechnung Deutschland) is a hybrid invoice format that was specially developed for the exchange of electronic invoices. It integrates the PDF/A-3 standard and offers the option of embedding an XML invoice in a PDF. The PDF/A-3 format implements the audit-proof archiving required by the tax authorities. This fulfills the principles for the proper keeping and storage of books, records and documents in electronic form and for data access (GoBD).

It also enables both humans and machines to read and process invoice data. A ZUGFeRD invoice consists of two components: a PDF document for the human reader and an XML file containing machine-readable data. This combination makes it particularly practical, as the format is suitable for small companies as well as large corporations and public administrations, and unlike the older EDI (Electronic Data Interchange) process, ZUGFeRD does not require both contracting parties to reach a prescribed agreement in advance. Invoices can be exchanged as required by both contractual partners. Save yourself the administrative effort and reduce additional working time.

Paperless invoicing – the future for all entrepreneurs

Added to this are the considerable advantages in terms of time and cost savings, as there is now no way around paperless invoices. The reasons and advantages are obvious. In addition to cost and time savings, e-invoicing speeds up internal processes. Invoices are created, processed and archived more quickly and thus ensure more cost-effective processes.

In this context, the EU has adopted the EU standard EN 16931, which describes exactly how an electronic invoice must be structured. The background to this is the overloading of the offices of the European Union. The high cost of processing paper documents in particular contributes to this. Among other things, the EU standard stipulates that all public offices and public service providers must already support electronic invoice receipt from 2020 and that all other companies must follow suit in the next three years due to the e-invoicing obligation.

ZUGFeRD vs. XRechnung

Another well-known standard for electronic invoicing in Europe is XRechnung. While XRechnung is primarily mandatory for the public sector in Germany, ZUGFeRD offers more flexibility and is used in various sectors of the economy. ZUGFeRD supports different profiles that meet the needs of small and medium-sized enterprises (SMEs) as well as the requirements of large international corporations. Both standards comply with the EU directive for electronic invoices, but ZUGFeRD is becoming increasingly popular due to its hybrid structure.

Compatibility with DATEV

DATEV was involved in the development of the new ZUGFeRD standard and therefore also supports the format. The creation of electronic invoices in ZUGFeRD format is possible with various DATEV applications, such as DATEV Rechnungsdatenservice 1.0.

Advantages of the ZUGFeRD standard

The introduction of ZUGFeRD brings numerous advantages for companies of all sizes:

- Cost and time savings: As ZUGFeRD is machine-readable, invoices can be processed automatically and integrated into accounting systems, reducing the need for manual input.

- Error prevention: The digital transfer of invoice data minimizes the risk of input errors that often occur with manual data entry.

- Legal conformity: ZUGFeRD fulfills the European and German requirements for electronic invoices. In particular, it is compliant with EU Directive 2014/55/EU and the German requirements for storing and archiving invoices.

- Broad acceptance: Thanks to its simple integration into existing systems and compliance with international standards, ZUGFeRD is accepted by both private companies and public administrations throughout Europe.

- Hybrid format: The combination of PDF and XML enables easy readability for humans as well as automated machine processing. This facilitates collaboration between companies of different sizes and technical equipment.

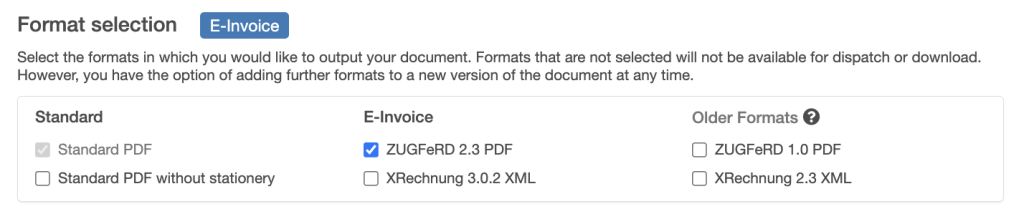

easybill supports ZUGFeRD 2.3

Another sign of the increasing importance of ZUGFeRD is the support provided by software providers. For example, easybill, a leading solution for the simple creation and management of invoices, now supports the ZUGFeRD format in version 2.3. This version offers enhanced functions and optimized compatibility with other e-invoicing standards such as XRechnung. Companies that use easybill thus benefit from a future-proof solution for electronic invoicing that works smoothly with both national and international business partners.

Documents are sent free of charge by e-mail in easybill. Use the DATEV export even in the smallest version of the easybill packages (BASIC package).

Future-proof solution for companies in any industry

E-invoicing is the future of accounting, and with standards such as ZUGFeRD, companies have an efficient, legally compliant and future-proof solution at their fingertips. Especially in times of digitalization and increasing globalization, it is important to rely on a format that meets the requirements of the European and international market. With the support of ZUGFeRD, especially in the current version 2.3, the exchange of invoices is both simpler and more secure – a benefit for companies of all sizes.

Read also:

Mehrwertsteuer in der Gastronomie: Erfolgsstrategien für Betriebe

Handwerker Rechnung: Lohnkosten und Materialkosten getrennt ausweisen

Neu: E-Rechnungen empfangen und Belege per KI erfassen