Simple. Efficient. Successful. Automate your invoices.

The smart solution for self-employed professionals

Automate your invoice management with easybill. Save time, minimize errors, and focus on your business. Discover how easybill makes self-employment more efficient.

Time-saving in invoice management

No missing mandatory information

Faster order processing and time-saving

Professional invoice design

Customize invoice

Create the foundation for all your invoice templates within minutes with the Layout Editor. Add your custom logo or stationery, upload your own fonts and customize the look of your invoice template according to your ideas. Create as many templates as you like online at any time.

Strengthen your brand and impress your customers with a custom invoice that not only reflects your branding, but also reinforces your business identity.

Layout and template editor for individual invoices and other documents

Use your own logo or stationery

Add useful tools like QR codes and PayPal button

Customize the invoice number format according to your needs

Flexible column labeling

Invoice creation made easy! Benefits for self-employed professionals.

Automate your daily tasks with easybill. For many self-employed professionals and entrepreneurs, invoice creation is a tedious obligation that needs to be done. But it can be different! What if invoice creation and complete accounting could be done with just a few clicks? Easily keep track of open and paid invoices and completed transactions.

Watch our short introductory video to learn more about how easybill can assist you in your daily work.

Create invoices as a self-employed professional

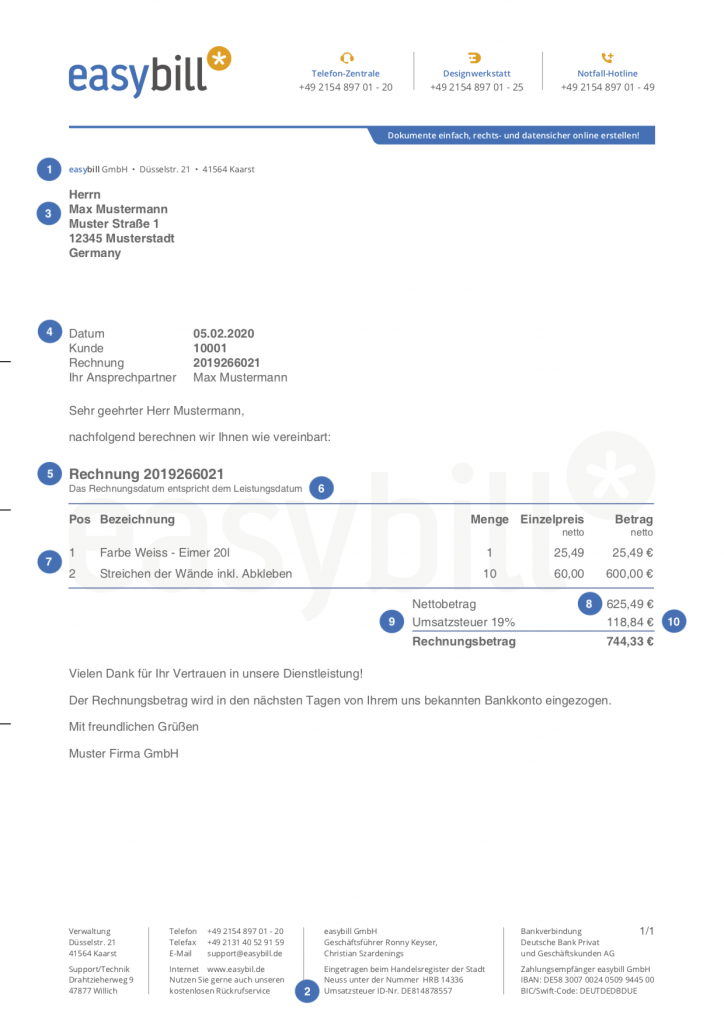

Mandatory information on an invoice

How do you write an invoice? What mandatory information must an invoice contain? It is recommended to include the following 10 components in the invoices as a matter of principle.

Full name and address of the company

Tax number or the VAT identification number

Full name and address of the customer

Date of issue / date of invoice

Consecutive invoice number

Time of delivery / service

the quantity and the type of delivery or the scope and the type of the service

Fee for the delivery / service in net

Sales tax rate on the omitted net remuneration

Sales tax amount on the omitted net renumeration

Maximize your efficiency and professionalism

with automated invoicing

Faster incoming payments, less administrative work and a professional appearance

Automatic generation of invoice numbers and dates for consistent documentation

Better compliance with legal requirements and tax regulations

Reduced administrative costs and fewer manual tasks

Frequently asked questions

about easybill

Self-employed persons can take advantage of certain statutory exemptions and lump sums when calculating their taxes. This means that they only have to pay income tax when their income exceeds the basic tax-free amount of 10,908 euros. It is important to observe these tax regulations in order to correctly record your personal tax situation as a self-employed person. It is advisable to consult a tax advisor or a tax authority for precise information on the tax regulations for your specific situation.

No. You do not need any previous technical knowledge to use an invoicing software like easybill. The software is designed to be user-friendly and intuitive. You can easily create invoices, manage customer data, add products and much more. However, if you have any questions or difficulties, easybill’s outstanding support is at your disposal. The support team will assist you at any time with technical questions and offer you extensive help. In addition, our help centre is available to you around the clock.

With easybill, your data is in the best hands. Your data is stored exclusively on servers in Germany and protected by modern encryption standards. As an additional safeguard, two-factor authentication (2FA) is available to you. Everything about account security in easybill.

To be able to test all features, our 7-day free trial period always includes the BUSINESS membership.

Using a tax advisor as a self-employed person is advisable because tax matters are often complex and time-consuming. A tax advisor can help you understand your tax obligations, develop optimal tax strategies, take advantage of tax benefits and ensure compliance with applicable laws and regulations. It is advisable to compare different tax advisors and choose one that fits your specific needs and business. Benefit from our tax advisor network and find a suitable partner for your tax affairs.

You can easily customise your invoices with our layout and template editor. Alternatively, you can use our free invoice template to create and send invoices with your company logo.You can also find a free invoice template without VAT for small businesses here.

Personalised invoices help you strengthen your brand and make a better impression on your customers.

Yes, there are no hidden costs. Shipping credit must be booked separately, actively. You have full cost control at all times. Please note, however, that you must book the shipping credit separately and actively. Costs for additional employee accesses and finAPI transactions can be found in the price overview.

All paid memberships are available on a monthly, quarterly, half-yearly and yearly basis. You decide on the membership duration.

easybill experience

Additional features

easybill can do even more

easybill.|Rechnungen.| online schreiben.|