Taxdoo

Automated VAT and Accounting for e-commerce

Start at € 0 per month/ 30-day test version

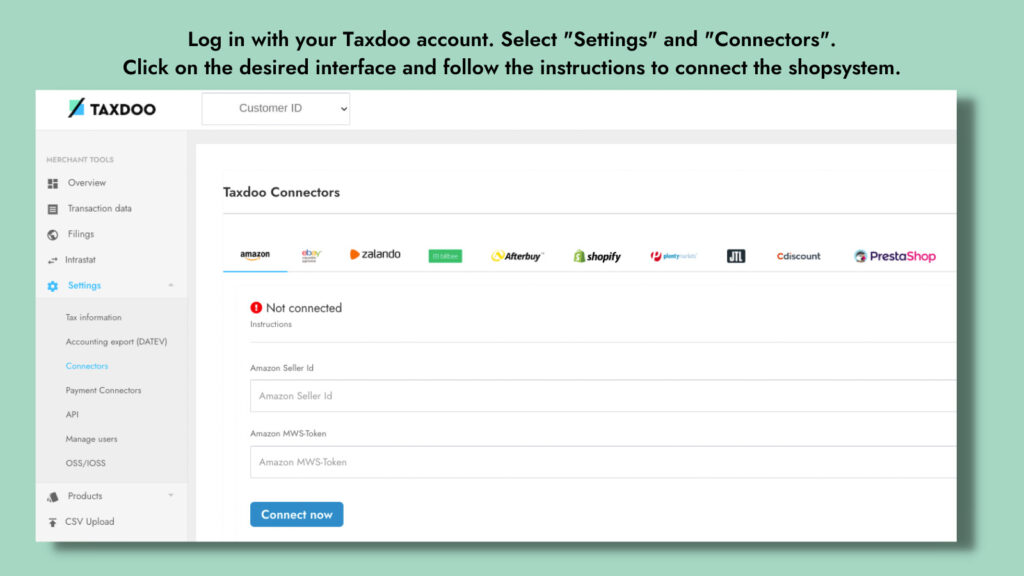

Taxdoo is a fully automated VAT and accounting solution for online merchants selling on Amazon, Shopify and other marketplaces, shop, and ERP systems.

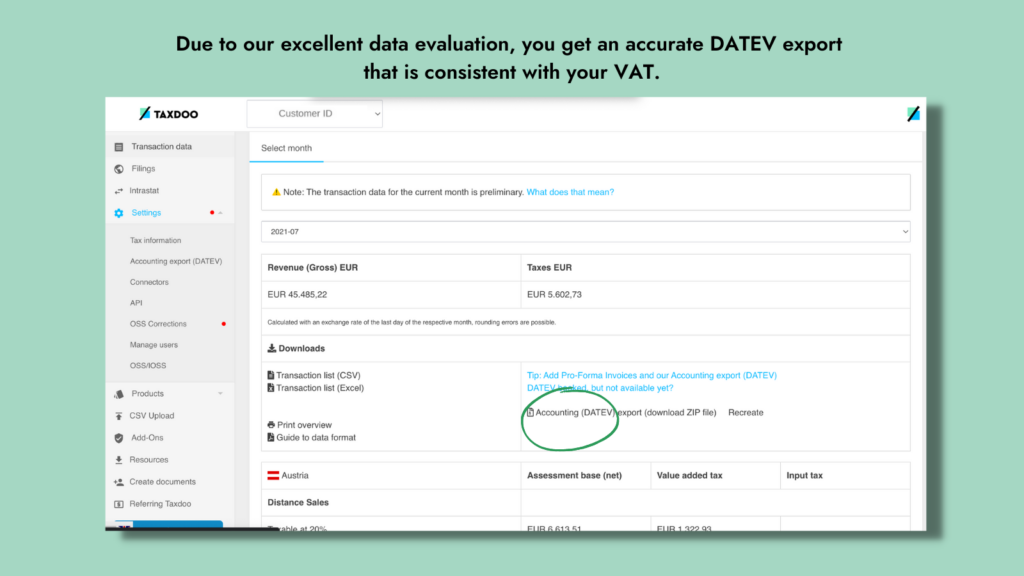

Taxdoo’s API-based platform replaces tedious manual tasks and reduces the financial risks of cross-border trade in the EU.

Data Collection

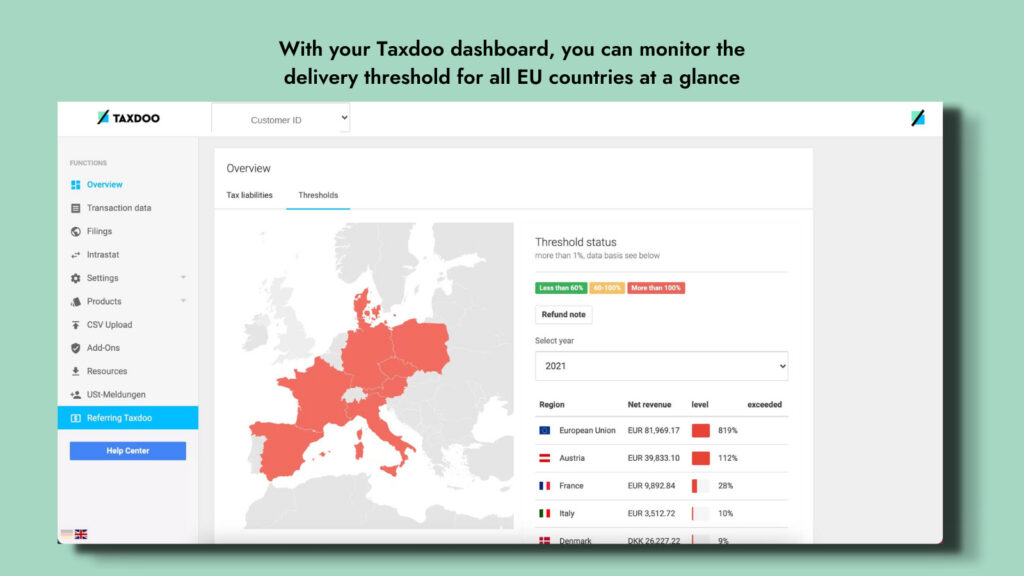

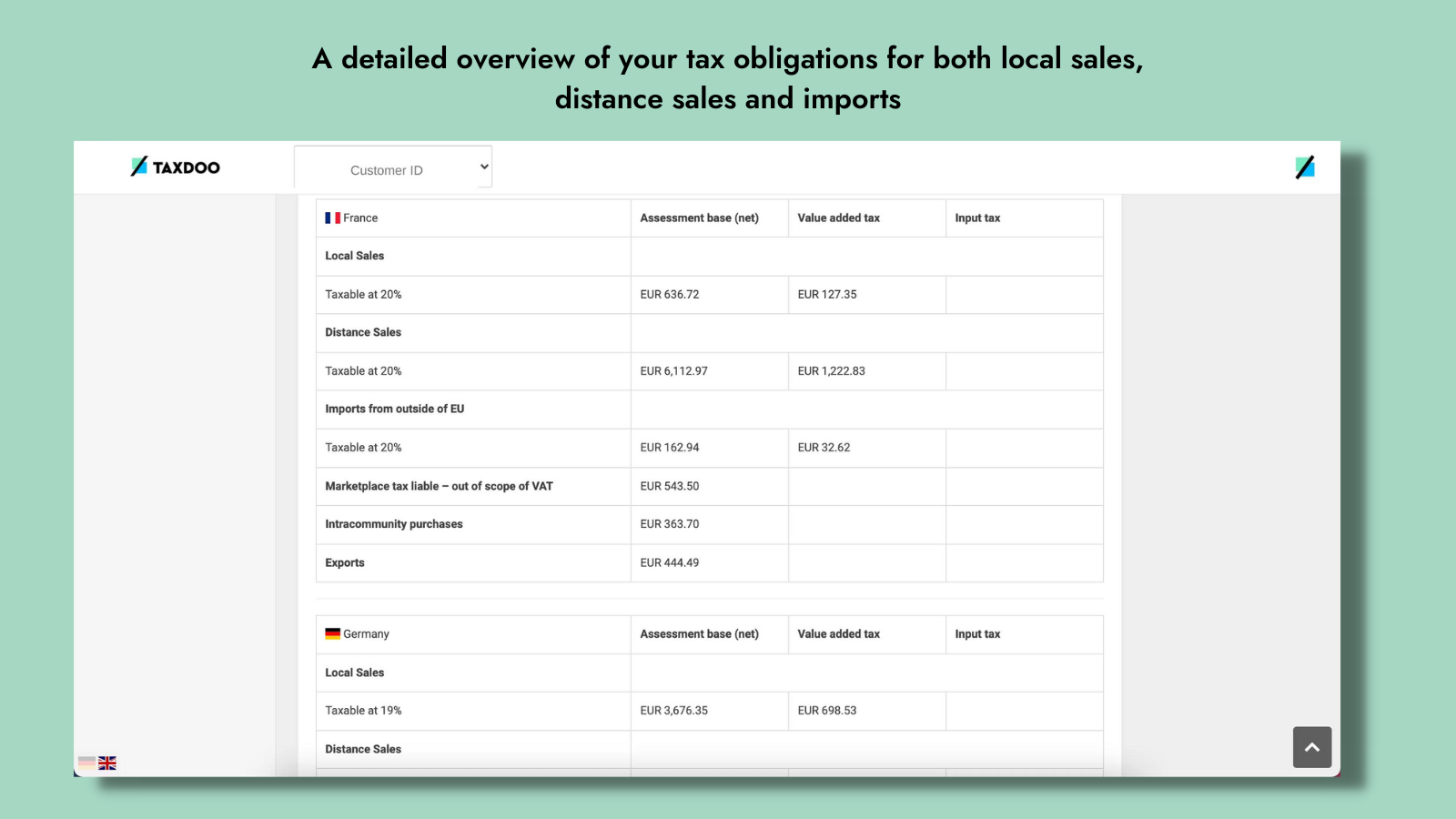

Monitoring and Evaluation

Add-ons

Additional Services from our Partner Tax Advisors

The following services come at special rates and can be arranged on request with our Customer support team.