This is a question that many people ask themselves time and time again. Even at easybill in support, the question often comes up whether you need an invoice software as a private person, for example, and whether you are allowed to write invoices at all. We are happy to address the issue of “writing invoices without a business” for you and explain the background.

A quick overview in advance

Writing invoices without a trade – who is affected?

Basically, the issue only applies to two areas or groups of people: either private individuals or freelancers. All other persons would act as a company and here, of course, the question of legitimate invoicing does not arise. So how do the two affected areas differ from each other? You can also find a detailed presentation on the topic of freelancers in the industry overview on the easybill website.

Freelancer

As a freelancer you are active in the following areas:

- Physicians and therapists (e.g., also alternative practitioners)

- Creative and publishing professions: Authors, editors, journalists

- Legal and tax advisory professions

Basically, such a company differs from other companies in that it is not necessary to register a business. Does it work without registration? No, of course you have to register as a freelancer with the tax office in order to get a tax number, which is a mandatory part of your invoices. But you do not have to pay trade tax. No business registration – no business tax!

Private person

The other option for writing invoices without a business is the private person. This means that you do not have a business, nor do you carry out one of the so-called “catalog professions” of a freelancer. As a private person, however, you sell an item once and want to create an invoice for it? Of course, it is important that you make sure that it really is not a commercial activity. If, for example, you sell the same item several times, the tax office could assume that you are acting commercially. With regard to the invoice, the same obligatory information applies to you as to a freelancer, but you may omit the specification of an invoice number and a tax number (because you do not have these).

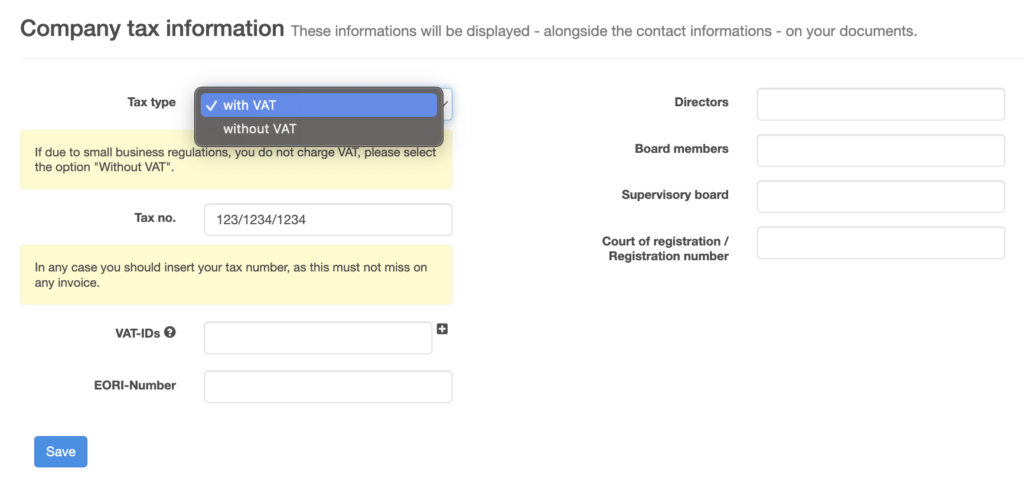

easybill invoice without VAT

Very important! If you belong to one of the above categories and you would like to use easybill as an invoice software, then activate in your account, via the tax master data, that you do not wish to have a VAT statement. A reference to the small business regulation is automatically inserted in your documents, which you can of course edit if the circumstance does not apply to your situation.

Excursus: Small business regulation according to § 19 UStG

While we are on the subject of invoices without VAT, let’s take a small excursion into the area of small business regulation. As the name suggests, we are talking about a regulation that concerns the person of the entrepreneur and not the company itself. Therefore, it would not be permissible for an entrepreneur to run several companies and to use the small business regulation in each of them, since all turnovers count in total. No tax is shown in the invoices of the small entrepreneur. In addition, he must indicate the application of the small business rule according to §19 UStG.

Conclusion about writing invoices without a trade

It is basically possible as long as the above criteria are met. The implementation in easybill is of course possible for you as a freelancer or private person and can be set up with just a few clicks.