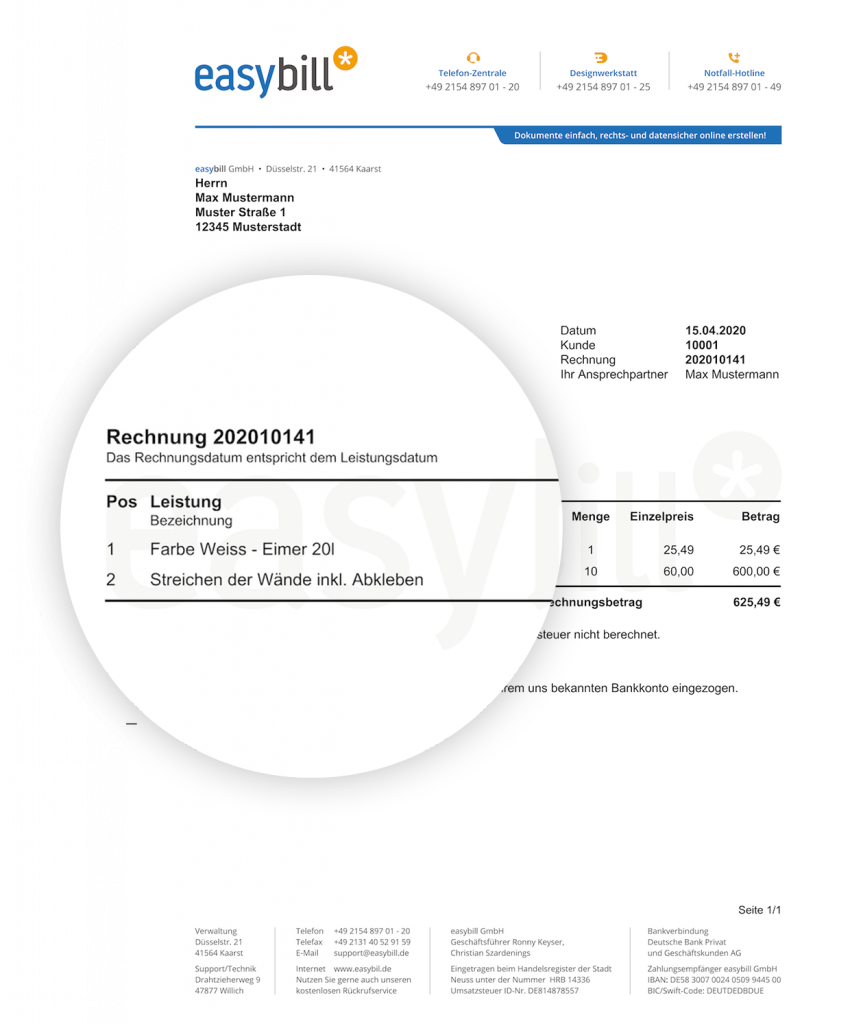

Invoice number: This is what you should pay attention to

Invoice number

You should definitely pay attention to this

The correct invoice number is more than just a number on the invoice. This is because the tax office insists that invoices are numbered correctly. If they are not, you can expect high additional charges. But even apart from that, you are well advised to use unique invoice numbers. After all, your customer will hold your invoice in his hands at some point.

What do I need to know?

A unique invoice number helps to assign a transaction exactly to an invoice. This is not only useful for you, but is also required by the tax office. In the event of a tax audit, you must be able to prove how many invoices you have written each year.

But that is not all. Each invoice number may only be assigned exactly once. In this way, you can ensure (in a way that is traceable for the tax office) that you have not billed products or services twice.

The regulations on how a legally compliant invoice number must be structured can be found, among other things, in the Value Added Tax Act Section 14 (4), which states what information an invoice must contain, namely “a sequential number with one or more series of numbers, which is assigned once by the invoice issuer to identify the invoice (invoice number)”.

Structure of an invoice number

As long as each number is assigned only once and the invoice can be clearly assigned to a specific transaction, the most important requirements are already met.

This also means that you are largely free to choose your own invoice numbers. Nowhere is it stipulated that the first invoice of the year must be 2020-001, for example.

The legal requirement merely states that it must be one or more number ranges that can be clearly assigned. How this or these number range(s) are structured is up to you.

Among others, the following invoice numbers are conceivable:

- 31012020-001

- 20203101-001

- RE-NR-3101-2020-001

- RE-NR-Jan31-2020-001

- 123456789-KU-0815

You can almost let your imagination run wild if you like to create individual invoice numbers. However, this is not a default.

By the way, just as little as the assumption of some entrepreneurs that the invoice may only consist of numbers. As you can see in our examples, a combination of numbers and letters is also possible without further ado.