Direct debit is still one of the most popular payment methods in daily business. Especially for companies it means to get faster liquidity and also the part on the other side, the client or customer, has less work. The payment is simply debited from his account as agreed, without him having to go to the trouble of remembering to pay on time or even falling into arrears. Because then it can get really expensive.

Table of contents

Transactions via finAPI in easybill

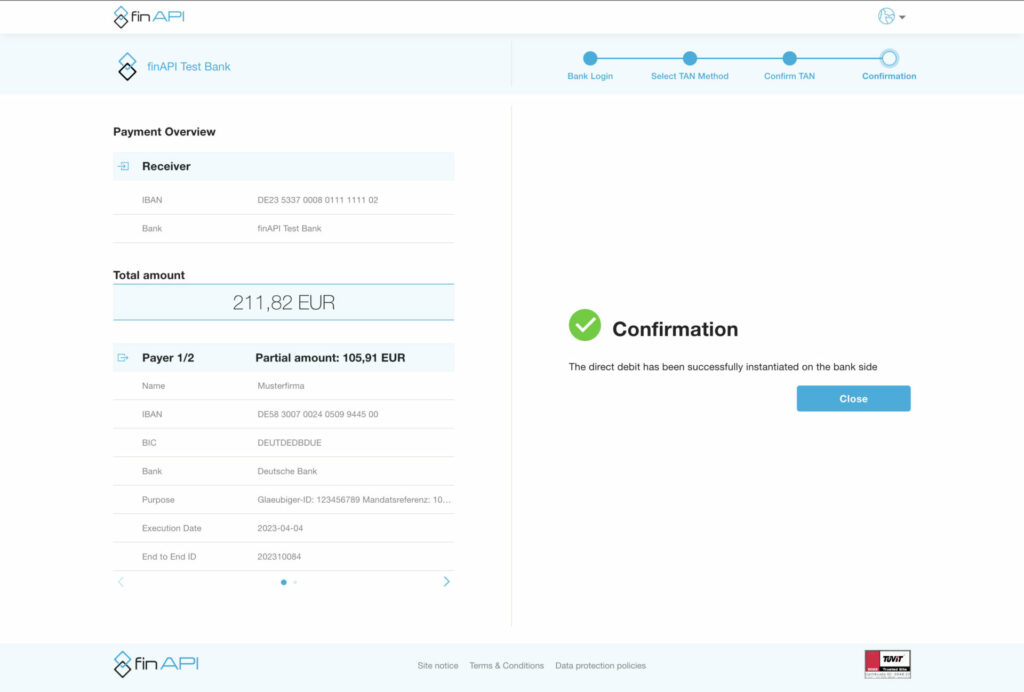

In order to simplify the topic of liquidity, especially for our easybill users, we are proud to present the newest feature in easybill this week: Direct debits via finAPI. Or even better: Control transactions via finAPI, because not only the invoices play a role here. Generate a data record directly from your invoices or even credit notes for transfer to finAPI. Save yourself the download of the file and the manual effort to transfer the previously generated data records from your computer back to your bank via online banking.

The new finAPI bank transaction makes your life easier. finAPI mediates the data record between easybill and your bank. There is no need for the additional step in online banking, since your account is already connected to finAPI anyway. finAPI, in turn, then transfers the corresponding information as to whether an invoice is to be settled by direct debit or a credit note is to be paid by your bank by bank transfer.

Feel free to read our detailed instructions in the Help Center:

Transmit direct debits/transfers to the bank via finAPI (in german)

From 23.03.2023

live for all easybill users: transactions directly from your easybill account out via finAPI interface to your bank.

Important for you: Obtain SEPA mandates from your customers

How can you prepare for the new feature as quickly as possible? Start immediately by obtaining SEPA mandates from your customers. Manage these mandates directly in easybill and store all payment details in the respective customer master. Only with a valid SEPA mandate can the direct debit be generated via finAPI in the account.

You are just wondering how such a SEPA form should look like so that you can give it to your customers? We have prepared a blank form for you to download here: Direct debits in easybill

Direct debits in easybill – important requirements

In order to generate direct debits via SEPA XML in easybill, you only need a creditor identification number, which you apply for at your bank. If you have yourself activated there for the direct debit procedure, you will automatically receive the creditor ID. In addition, as already mentioned, you need the necessary SEPA mandates from your customers. With direct debits via finAPI, however, you will have to deal with additional special features.

Prerequisites for collecting direct debits via finAPI:

- The account model of the business account must be activated for direct debits at the bank.

- Technically, the account must be activated for the use of HBCI/FinTS.

For our customers from Austria there is unfortunately currently no possibility to generate direct debits via finAPI in easybill, because the submission of direct debits is currently not part of the PSD2 XS2A regulation. The process is therefore only possible with FINTS_SERVER interface for German banks. In Austria there is only the XS2A regulation and FinTS is a purely German system. Should there be any changes here in the future, we will of course report on them.

Read also:

Priceless Updates

Do you already know the optimized action search in easybill?

Why the partial invoice is still so important in the craftsman sector