We do not want to withhold the first innovation in the new year 2023 from you. Many have certainly already seen them in the account, but since we know from experience that often even useful functions are not found immediately, we are happy to continue our blog series of “priceless updates”.

Are you new to easybill? Then you’re just getting to know the benefits of our outstanding customer support. You’ll soon be almost enjoying the ease of work that easybill gives you. And to make sure you always stay in the picture, here is an overview of the absolutely valuable further developments of the last time.

Table of contents

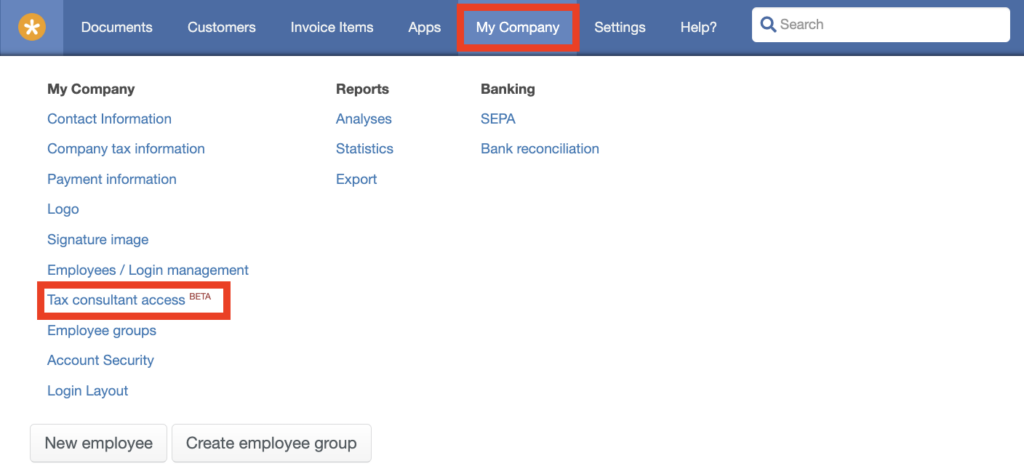

Tax consultant access: management also in FREE, BASIC and PLUS

For users who have not booked the BUSINESS package, this menu item may be new. Employee access can only be set up in the BUSINESS package. However, since we now offer the easybill tax advisor portal, each of our customers is of course free to grant their tax advisor access to the account, regardless of their booked package.

Other accesses, for employees for example, can still not be set up. It is best to invite your tax advisor immediately to create their own easybill account and to link both accounts. You can find more information directly on our website.

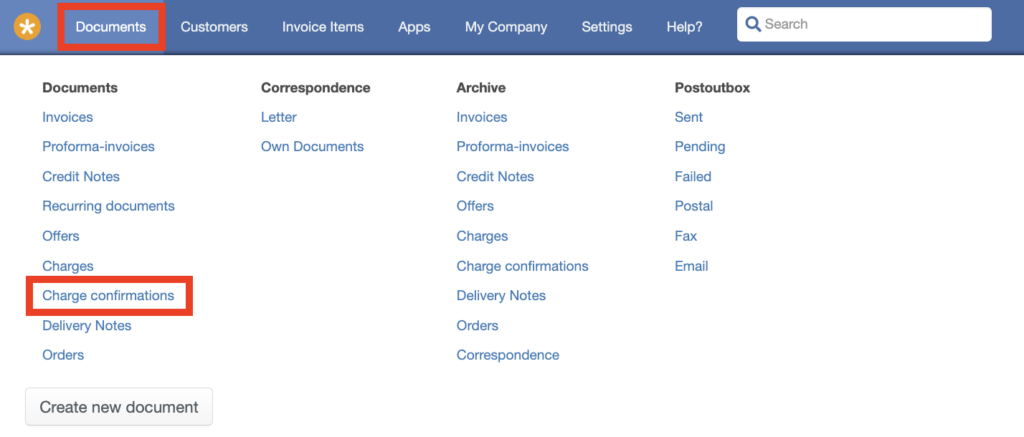

Charge confirmation independent document type

You create an charge and your customer confirms this to you. For internal purposes or for further confirmation to your customer, you also want to create a charge confirmation. Until now, the charge confirmation existed only as a follow-up document of the charge.

From now on, no workaround is necessary to create an charge confirmation directly. Via Documents you will now find the separate area for your charge confirmation. Via Create document you create a new charge confirmation in the account, even if there is no charge document.

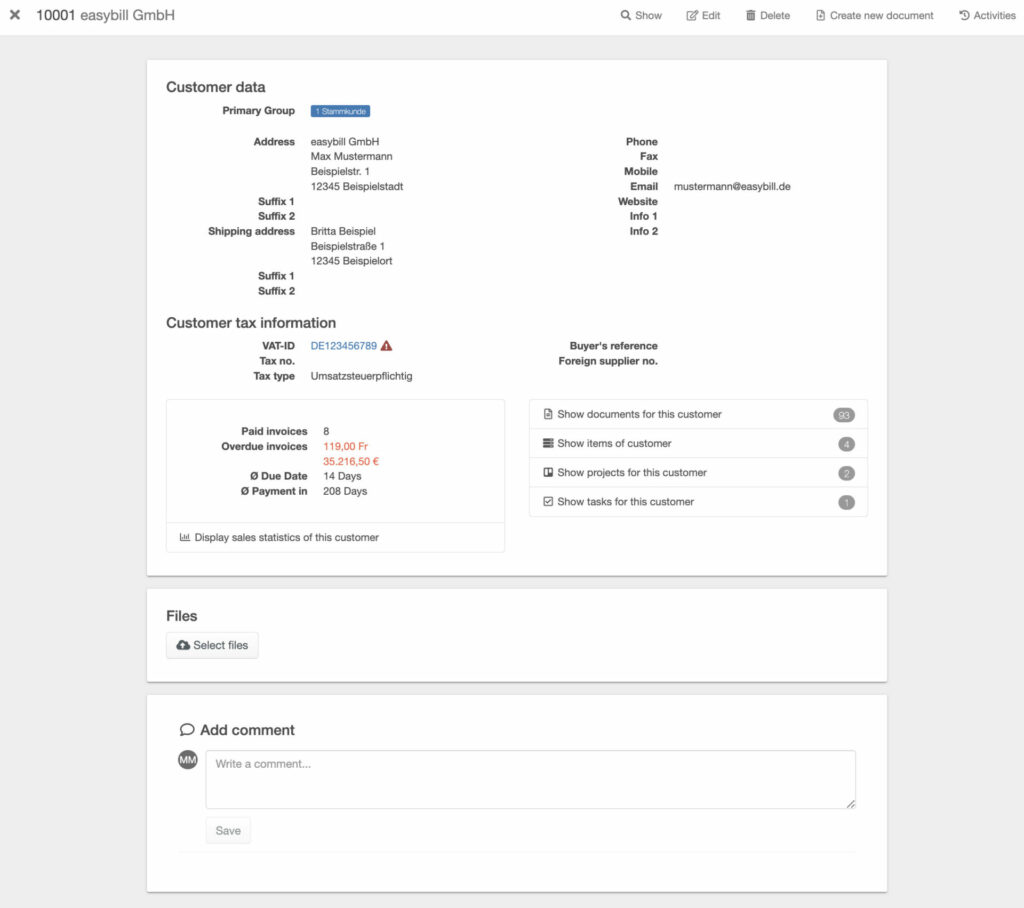

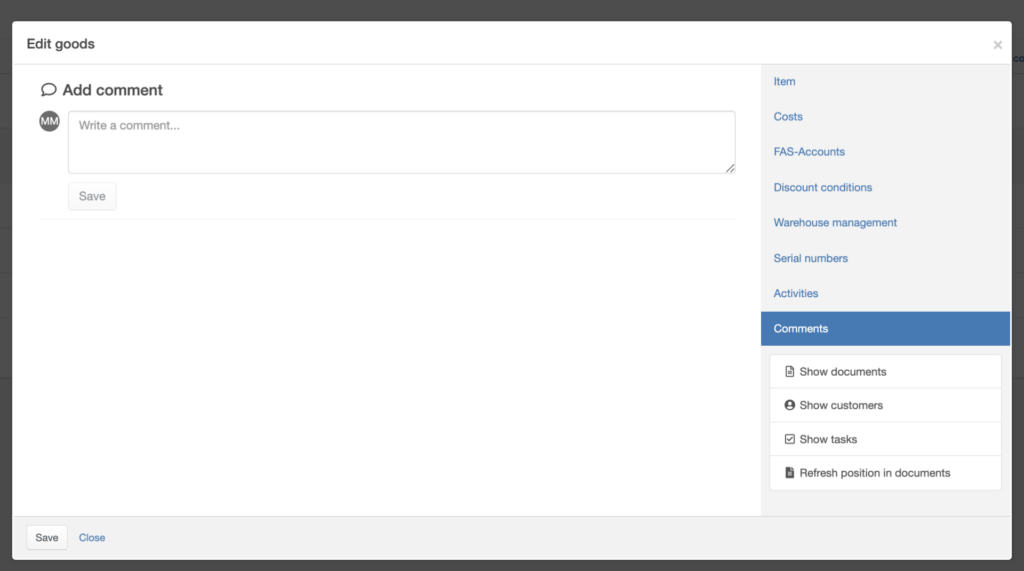

New comment functions

So that your internal coordination in the team can take place hand in hand, comments usually facilitate the work. Especially when several users work in the same account, it is often necessary to coordinate.

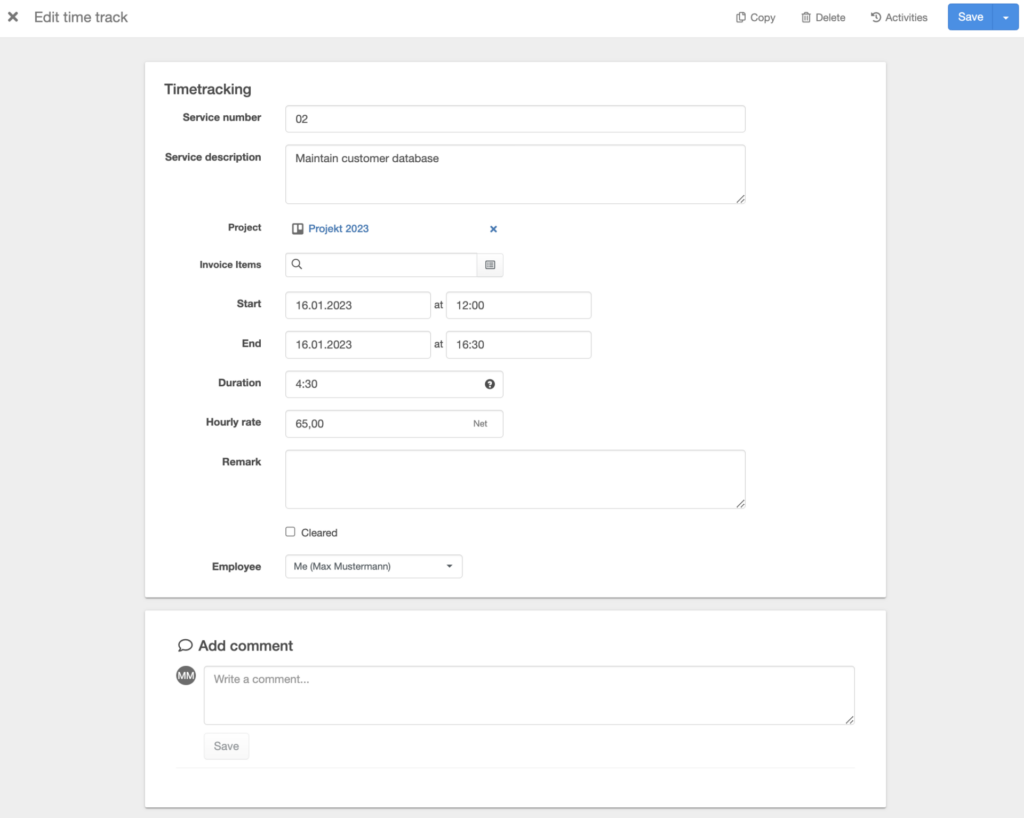

To facilitate these work steps and to make actions in the account easier to follow, you can now use the new comment function for customer and invoice item groups. Equally important to us was the comment function for time entries. This should not be confused with the comment field in the time entry, as this would also output the note (when using the associated placeholder) in the document. The comment for the time entry is internally visible for all users.

Updates around the Import Manager

We also keep our online retailers up to date when it comes to updates to store connections or marketplaces. Without explaining the changes in detail, you can still get an overview here:

- Kaufland All users have been upgraded to the latest version of the Kaufland interface (V2). In addition, Kaufland has recently started offering “Fulfillment by Kaufland” (FBK for short). The previous version V1 was not able to retrieve this order, making an update inevitable.

- ETSY Digital goods are from now on no longer converted into invoices when imported as purchase orders. ETSY takes care of the invoice generation itself here.

- Shopify the outdated and especially unlisted easybill app is no longer available. All users had to switch to the new easybill app in the Shopify app store.

More priceless updates?

Update on the document editor

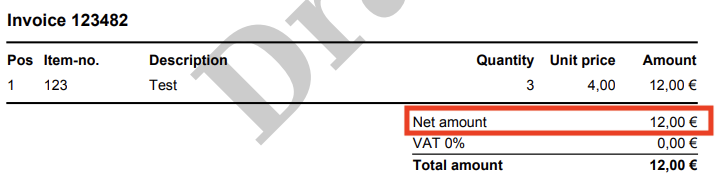

In fact, this year’s tax innovation of 0% taxes for photovoltaic systems led us to adjust our presentation in the document editor. Until now, the net total amount in the document was omitted if the items or the entire document contained 0% taxes. Thus, only the reference to the tax rate and the invoice amount was displayed. However, since the display of the net total amount is now also mandatory, we have included this change.

finAPI updates removed from background processes

One or the other may have wondered. Via the notification of the background processes in your account, every synchronization process of bank transactions via finAPI was also displayed. However, since we now assume that most users prefer the bank reconciliation route anyway, we have made the background processes a bit more streamlined.

If you are still interested in this information, you can still find it via Apps > finAPI by clicking on the stored bank details and there again via the activities.

Additional tip: Our finAPI bank account reconciliation now also reconciles transactions in foreign currencies! If you use this function for your bank account, nothing stands in the way of a link.

Read also:

Do you already know the optimized action search in easybill?

Why the partial invoice is still so important in the craftsman sector

The most important functions at a glance

Or check out our YouTube channel easybill TV!