Open invoices are an absolute chore for you as a small business owner? Many small business owners start their business as “lone warriors” and cannot yet rely on employees for support. This means that both the offer management for new customer acquisition and the invoicing for existing customers are centrally in one hand. In your hand. And then there are the unpaid invoices on top, which make life difficult for you, because liquidity is extremely important for your company.

So how about an automated dunning solution for small business owners? Imagine you could just sit back and cede the dunning process. We’ll show you how it’s done.

Inhaltsverzeichnis

Reminders and reminders advice page

As usual, easybill is there to support you. In our guide, we inform you about the most important topics concerning your business. There you will find answers to all the questions you may have when you are just starting up a business. Or, of course, if you have been in business for a long time as an “old hand” but have never come into contact with some topics before.

Wondering how to correctly calculate reminder fees? Read all the important information here: Guide to reminders and payment reminders.

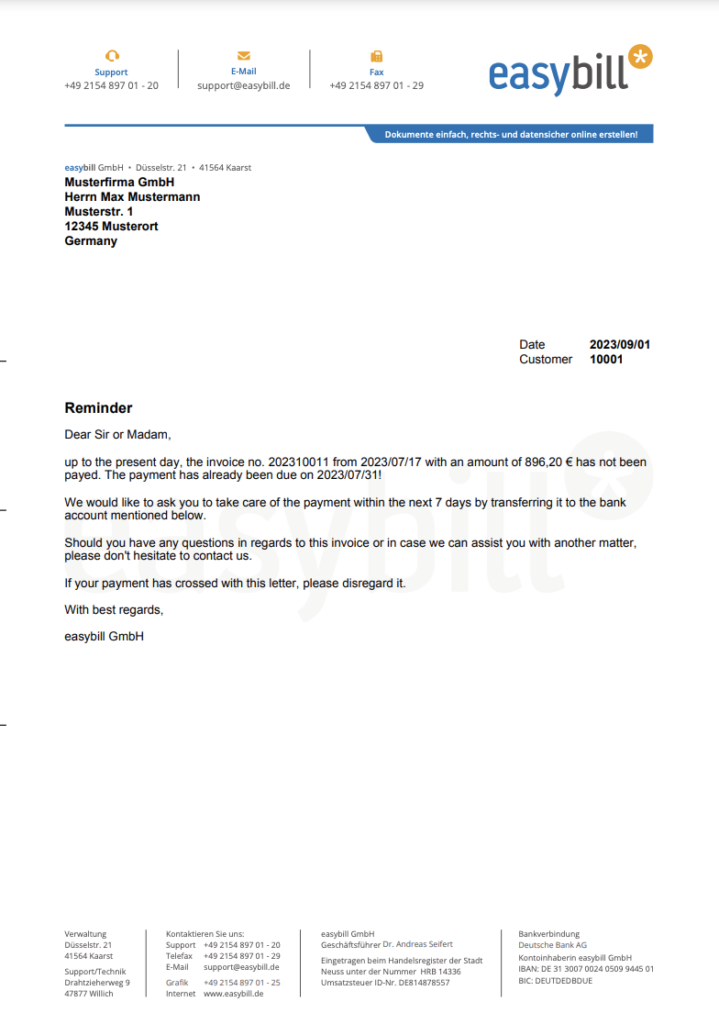

easybill Reminder Templates

Once you have learned what a reminder or a payment reminder is all about, you can directly use the standard templates in the easybill account.

As in all other areas, we provide you with templates in German and English, which you can of course adapt to your own ideas. However, if you do not know how to formulate a reminder to start, our texts are a good start.

As a tip for all those who do not yet have an easybill account: You can find lots of free templates to download via our service area on the website. This is not a bad way to get started, and switching to easybill as your software is also done in no time at all. Your design will not even change, because the free templates are adapted to our easybill design.

Dunning levels and strategies

What should be considered in the dunning process for small businesses? Basically, of course, the same guidelines as for any other entrepreneur. Stick to common rules, such as starting the dunning process with a friendly reminder. It often happens that an invoice is overlooked or forgotten by the recipient due to internal passing on.

But of course, since you depend on liquidity in your business and the payment of each invoice, you should develop a dunning strategy and stick to it. Start with a friendly reminder, followed by a first, friendly, reminder, which, however, already brings a bit more pressure. Perhaps your strategy already ends with an impressively formulated second and final reminder.

You should not provide too many reminder steps so that your counterpart does not keep postponing payment. In any case, do not forget to set a deadline in each letter so that, if necessary, the claim can be collected by court in the event of uncollectibility.

Optimize dunning until you can save it

Dunning is also a process for small business owners that can be gradually optimized. If you find that your initial strategy is not achieving the desired result, adjust it. Reconsider your appearance within the documents, the vehemence of setting deadlines and the wording of your reminders.

Even though it would be desirable to be able to do without reminders completely as a small business owner so that all the extra work doesn’t fall on your shoulders, it’s unlikely to be able to do without reminders or dunning letters altogether. So how can you optimize the process for yourself to save time and effort?

Automation and software solution for dunning

easybill supports you as a small business owner by trying to relieve you of as much workload as possible – in the area of invoice management. A manual dunning system is of course always available to every user. The BUSINESS package is worthwhile for those who want the complete service and would like to benefit from the automatic dunning process (as well as other additional functions).

You control the automatic creation of payment reminders and dunning letters in easybill via a rule you specify. Exclude specific customers from the rules or create rules only for some customers. The choice is yours!

Most importantly, you can sit back and not have to do a thing. Doesn’t that sound tempting?

Better to make provisions and avoid unpaid bills

Despite all the possibilities for an optimal dunning process, your top priority is, of course, to prevent an open invoice from occurring beyond the due date. Use the easybill PayPal button or the direct payment function via Better Payment to simplify the payment process for your customers.

Why wait for payments? Check for your business whether direct debit would not be a perfect alternative. Store your customers’ SEPA mandates in the easybill account and generate automatic SEPA direct debits for each invoice. Then no payment is guaranteed to remain unpaid.

Read also:

Maximum efficiency: why using a tax consultant trumps the do-it-yourself approach to accounting

Better Payment for a higher liquidity of your company

Invoices, taxes and co.: How to create private invoices correctly