*Guest contribution: CountX GmbH

How marketplace sales in the UK can become a tax trap for online retailers

Brexit is imposing many changes, new regulations and associated challenges on EU online retailers selling to the UK.

One example in this long list of innovations is the so-called marketplace liability (“marketplace facilitator”). Similar to the USA, this has now also been in place in the UK since January 1, 2021. Among other things, this liability means that a marketplace such as Amazon must pay VAT on transactions on its platform and therefore also issue invoices to the end customer. For external invoicing systems that create invoices based on marketplace transactions, this now presents a choice. Either continue to include the transactions from the UK in the invoicing process or exclude these invoices for the UK.

Case 1: Invoices for Great Britain are taken into account

If the transactions are taken into account, invoices are thus created by two invoicing systems for a single transaction in each case. This has the theoretical advantage that all invoices continue to be taken into account in at least one invoicing system and can also be transmitted collectively (e.g. via DATEV data service) to the tax advisor. However, the UK invoices then show a VAT liability for the online merchant. However, as described above, this is the responsibility of Amazon and is also paid directly by them. Thus, VAT obligations are booked in the online merchant’s accounting and, in the worst case, also reported and paid that do not actually exist.

Case 2: Marketplace invoice is not integrated

The other option, as also handled by easybill, is to exclude the transactions for the UK from the invoicing process. This means that only one invoice is created per transaction and the tax burden is always shown correctly.

For the completeness of the accounting, every invoice must be available. This means that all invoices from two different invoicing systems (Amazon and easybill) must be taken into account by the tax consultant. This presents many tax consultants with additional challenges when processing, checking and preparing the enormous amounts of data from online retailers.

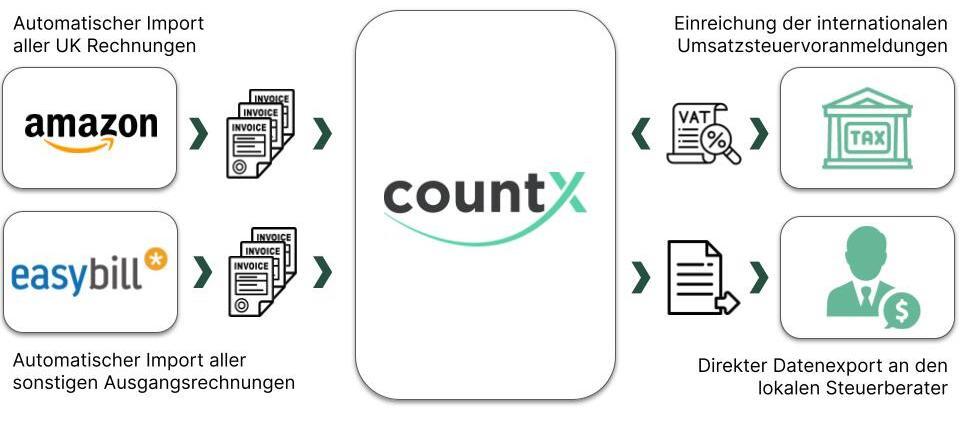

To remedy this, easybill, in collaboration with countX as a partner, has developed an automated and transparent solution that bridges precisely this gap between invoicing in easybill, Amazon as a marketplace for sales in the UK, and local accounting.

Merge all invoices for the UK automatically for accounting purposes

Through a direct integration to both easybill and Amazon, countX can automatically extract and consolidate all relevant data, structure sales in the UK and thus avoid duplication in invoicing and also in VAT payment. By directly submitting the monthly advance VAT return in the UK, there is no further effort on the part of the merchant. And through a ready-made DATEV export for local accounting, additional effort and also time is saved at the tax consultant.

Interested dealers for this solution countX offers a free consultation, which can be booked directly here.

CountX as a partner for the entire international value added tax

Overall, countX positions itself as the central point of contact for internationally operating online retailers when it comes to handling foreign VAT obligations. From the first sales to neighboring European countries with shipping from the local warehouse, to complex logistical warehouse networks throughout Europe (for example, via the Amazon FBA program), new tax obligations for online retailers are always involved. These obligations are handled by countX in an automated and legally secure manner.

The service includes tax registrations in all EU countries as well as regular VAT returns. CountX transfers these reports collectively to the accounting department of your local tax advisor. This process saves time and money, both for you and for your tax advisor.

Do you have further questions about storage and sales in the EU or UK and the associated VAT obligations? Then please contact our partner countX at

+49 30 6293155 99 or by email at sales@countx.com.