It is already on everyone’s lips, but if it should have passed you by so far, we would like to inform you once again in this way. The German Federal Ministry of Finance (BMF) has put forward a proposal that e-invoicing will become mandatory in the B2B sector on January 1, 2025.

Although it is not yet a done deal and the date is not fixed, it is certain that the e-bill will come in the next few years.

What does e-invoice mean anyway?

How did this proposal come about? In order to combat VAT fraud and close most of the VAT gap in Germany, or to avoid an even larger gap, e-invoicing is to come. In some German states, this obligation already exists when you have to invoice services to institutions or authorities.

Until now, this has been done using the electronic format of the XInvoice, or the ZUGFeRD format. The invoice is therefore no longer provided in paper form or even as a PDF document, but as a machine-readable XML file embedded in a readable PDF document.

Is e-invoice and PDF the same thing?

The answer is definitely no! Just because you create your invoices as PDF documents, if applicable, and make them available online or send them by e-mail, does not mean that you are therefore issuing an e-bill.

As mentioned earlier, the e-invoice must be machine-readable. So no simple PDF file will do here. Should you speculate on this, it is best to look around for another solution in a timely manner.

Preparation is the key

As an entrepreneur, you are already being advised to prepare for this changeover. How should you do this? By already discussing internally what know-how is necessary, who should be responsible and what all needs to be done to implement e-billing as easily as possible in the company. Because in the future, it will no longer be just the area of public authorities that will be affected, but every invoicing process in the B2B sector.

The advantages of e-invoice

Of course, the switch to e-billing first means change. Change is not always received positively, but e-billing in particular should be viewed in the long term. Especially small businesses or small entrepreneurs, who now also have to change over, have often had high costs up to now when it came to postage, paper, printers and other costs.

These costs are now eliminated in the long term if the e-bill is not transmitted digitally. However, once you decide on a software, check whether it also offers the required formats in the long term. Switching costs for your software should be avoided.

Avoiding tax loopholes should also be an important aspect in the general interest of every entrepreneur. The e-invoice and a subsequent central reporting point for all sales and invoices will ensure that every sale really arrives where the tax belongs.

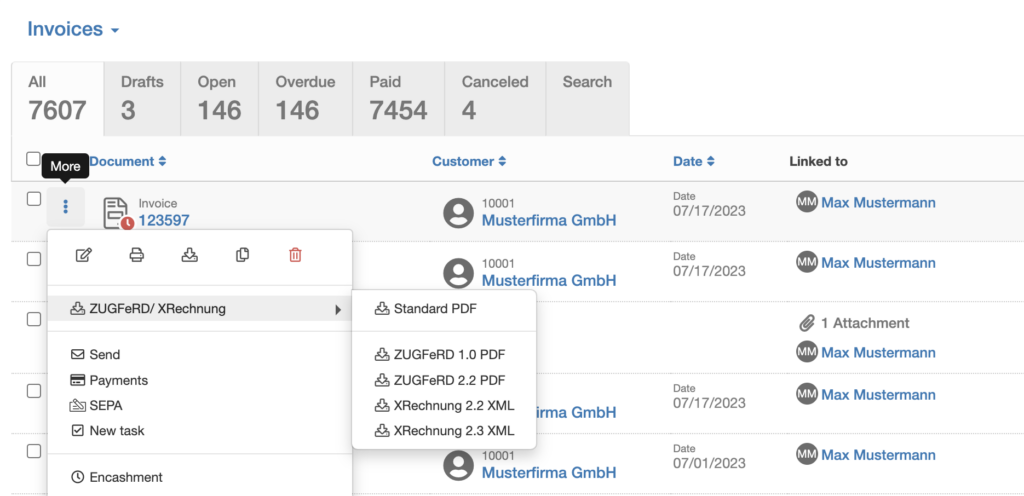

easybill supports ZUGFeRD and XRechnung

easybill already supports the specified formats of the XInvoice. Active easybill users can therefore remain relaxed for the time being. However, those who have not yet dealt with the electronic format of the e-bill are welcome to do so immediately.

As always, you will find comprehensive instructions on the ZUGFeRD or XInvoice format in the easybill Help Center (in german): Invoices in ZUGFeRD format (XInvoice).

If you still have questions, our support team will be happy to help you at any time.

Read also:

Vacation rental invoices: Our 10 points for your checklist

Successful invoicing for small business owners: 7 key facts for your business

XRechnung Documentation (german Help center)